As global competition continues to intensify, Chinese B2B companies are accelerating their expansion into international markets. After launching multilingual websites and establishing a solid foundation of localized content, many companies encounter the next critical question:

How should limited marketing budgets be allocated across overseas advertising platforms to achieve the highest return?

With options ranging from Google, LinkedIn, and Meta (formerly Facebook) to a growing number of regional and vertical platforms, many teams fall into “platform selection anxiety.” Should budgets focus on search ads, professional social networks, or short-form video channels?

The reality is that effective advertising strategy is not about chasing traffic trends, but about systematically aligning platforms with buyer decision journeys, product characteristics, and existing content assets.

This article provides a practical, execution-ready guide to overseas advertising platform selection for manufacturing and technology-driven B2B companies—helping brands move from broad experimentation to precise customer acquisition and efficient conversion.

I. Core Platforms: Building the “Trust Reach Triangle” for Global B2B

Today’s global B2B advertising ecosystem is anchored by three core platforms, each corresponding to a different stage of the buyer decision journey. These platforms are not substitutes, but complementary components of a complete trust-building triangle—from active intent, to professional validation, to brand resonance.

1. Google Ads: The Entry Point for High-Intent Demand

The core value of Google Ads lies in capturing explicit purchase intent. When buyers search for terms such as “precision CNC machining service in Germany” or “industrial IoT solutions for smart factories,” they are often already in the mid-to-late stages of the buying funnel.

At this point, a well-targeted search ad that leads to a localized landing page with clear language, detailed case studies, and credible certifications can convert efficiently.

However, Google’s effectiveness is highly dependent on website fundamentals. Without proper cultural adaptation, consistent technical terminology, and multilingual SEO optimization, clicks rarely translate into trust. Google Ads should therefore be viewed not merely as a traffic source, but as a trust handoff mechanism.

2. LinkedIn Ads: Where Professional Trust and Authority Are Built

As the world’s largest professional network, LinkedIn concentrates key B2B decision-makers—engineers, procurement directors, technical leaders, and executives. Its ad system enables precise targeting by job title, industry, company size, and even skills, making it particularly suitable for high-value offerings with long decision cycles, such as industrial equipment, automation software, and energy solutions.

More importantly, LinkedIn is not just an ad channel—it is a professional content distribution platform. A well-written article such as “How Predictive Maintenance Reduces Production Downtime”, amplified through Sponsored Content, often builds more credibility than direct promotional ads.

For manufacturing and technology companies, LinkedIn remains the primary platform for positioning as a serious solution provider rather than a transactional vendor.

3. Meta Ads (Facebook & Instagram): Amplifying Brand Warmth and Channel Activation

With more than 3 billion monthly active users, Meta platforms offer massive reach. However, for most manufacturing B2B companies, their value lies less in direct lead generation and more in brand familiarity and partner ecosystem activation.

Examples include short videos showcasing equipment use cases for distributors, or localized partner recruitment campaigns in Southeast Asia. Meta’s strength is visual storytelling and community interaction—but without prior professional credibility built through websites or LinkedIn, such content can easily feel superficial.

Meta works best when emotional resonance is layered on top of established professional trust.

II. Emerging and Vertical Platforms: Building a Regional Precision Network

Beyond Google, LinkedIn, and Meta, a growing number of platforms offer high potential when used in the right context. These platforms are not replacements—but precision supplements.

1. Regional Social and Content Platforms

🔹TikTok Ads (Global, especially Southeast Asia, Middle East, Latin America)

Often perceived as consumer-focused, TikTok’s B2B influence is rising rapidly in markets such as Indonesia, Vietnam, Thailand, Saudi Arabia, and the UAE. Manufacturing companies can showcase product operation, factory automation workflows, or engineers’ daily work to build technical approachability. CPCs are often significantly lower than in Western markets.

💡Landelion Insight: Best suited for standardized industrial products, SME integrators, and younger procurement decision-makers.

🔹X (formerly Twitter) Ads (North America, Europe)

X remains a key information source for professionals in technology, energy, and engineering. Keyword-triggered ads enable brands to appear alongside industry searches and discussions.

💡Landelion Insight: Content must remain informational and insight-driven—pure promotion undermines credibility.

🔹Reddit Ads (North America, Europe)

With highly specialized subreddits (e.g., r/Engineering, r/manufacturing), Reddit reaches deep technical audiences. Promoted posts can work when they add value and spark discussion.

💡Landelion Insight: Community trust is high; shallow ads are rejected, but useful content can spread organically.

2. Video and Search Platforms

🔹YouTube Ads (Global)

Now functioning as a major search engine, YouTube is critical for demonstrating product principles, customer cases, and installation tutorials. TrueView ads are well-suited for educational content.

🔹Microsoft Advertising (formerly Bing Ads, primarily North America)

While its global search share is modest, Bing users disproportionately include enterprise IT and procurement professionals. CPCs are often 30–50% lower than Google, and LinkedIn audience data can be used for retargeting.

3. Vertical B2B Platforms (High Precision)

These platforms offer lower traffic but higher intent, making them ideal for credibility and supply-chain access rather than mass acquisition.

🔹Thomasnet (North America): Major industrial sourcing platform

🔹EUROPAGES (Europe): Multilingual supplier directory across 28 countries

🔹Kompass (Global): Industry-code-based company targeting

🔹Alibaba.com (International): Strong presence in emerging markets

4. Southeast Asia–Specific Growth Platforms

LINE Ads: Thailand, Indonesia, Taiwan

Zalo Ads: Vietnam’s dominant social platform

Shopee / Lazada Merchant Ads: Effective for industrial consumables and tools

👉Platform Selection Principle: From Trend-Chasing to Precision

The guiding rule is simple: do not invest because a platform is popular—invest because your customers are there.

True global marketing is not about being everywhere, but about being everywhere that matters.

Conclusion: Choosing Advertising Platforms by Returning to First Principles

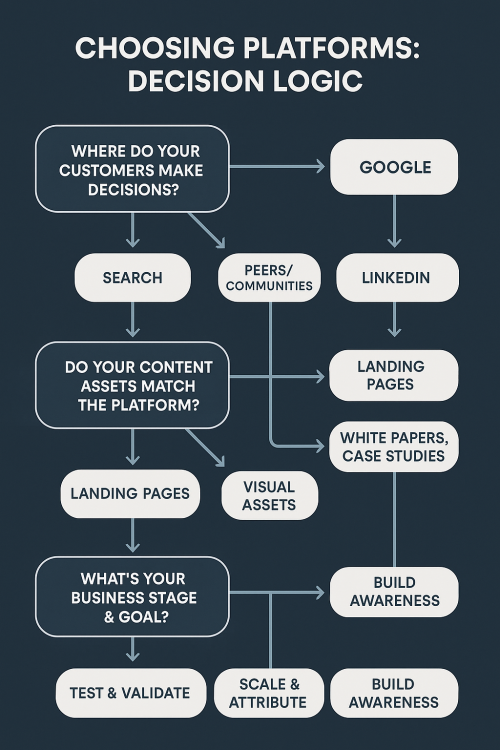

Ultimately, selecting the right overseas advertising platforms should come down to three fundamental questions.

1. Where do your customers actually make decisions?

If potential buyers actively search for suppliers when a need arises, Google Ads is often indispensable.

If purchasing decisions are heavily influenced by peer recommendations, professional communities, or industry discussions, LinkedIn tends to be far more effective.

If distributor networks and channel partners play a major role in market access, Meta platforms can serve as a useful tool to activate and support those ecosystems.

2. Do your content assets truly match the logic of each platform?

Google requires landing pages optimized for search intent, technical accuracy, and localized keywords.

LinkedIn relies on in-depth content such as white papers, expert articles, and customer case studies to build professional credibility.

Meta platforms, by contrast, demand strong visual storytelling and concise messaging to capture attention.

Without content that is structurally aligned with each platform’s consumption behavior, any advertising spend—no matter how large—risks becoming a wasted investment rather than a growth driver.

3. What stage is your business in, and what is the primary objective?

In the validation phase, focusing on a single platform allows teams to test assumptions quickly and control risk. During the scaling phase, combining multiple platforms and introducing attribution analysis becomes essential.

In the brand-building phase, video and narrative-driven content should be added to establish long-term market perception and trust.

True advertising effectiveness is not measured by how many people you reach, but by how many right decision-makers you reach—and whether, at the moment they are ready to decide, you are able to provide information they trust.

This is the essence of precision amplification in digital marketing, built on a solid foundation of localization, credibility, and relevance.

If you are scaling global growth and want your content to function as a repeatable growth engine—rather than a one-off communication effort—Landelion helps B2B teams design and execute content distribution systems aligned with real buyer behavior and platform logic.

📩 Contact us | Explore marketing solutions

💬 Add us on WeChat for a tailored solution

📚 Further Reading

Cracking the Code for Global Marketing Success: LinkedIn Topic Selection Strategies for Chinese B2B Manufacturers

2025 B2B Global Marketing Review & 2026 Trends: Executive IP, Localization, and Trust